Is Tax Evasion on the Radar? What You Need to Know!

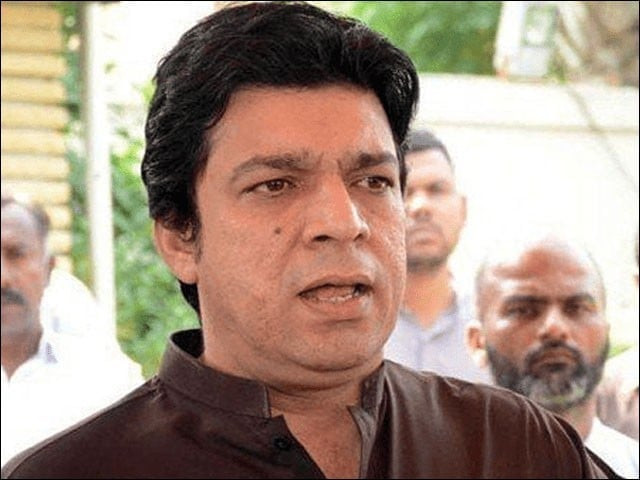

Hey there! If you’ve been keeping an eye on recent news in Islamabad, you probably heard about the Federal Board of Revenue (FBR) stepping up its game against tax evasion. Senator Faisal Vawda recently dropped some big statements, warning individuals and companies that they can’t hide behind discrepancies between what they declare as income and their lavish lifestyles. Sounds like a wake-up call, doesn’t it?

So, what’s the scoop? Vawda mentioned that the FBR has been busy compiling lists comparing declared incomes to the visible luxury lives people showcase on social media. Imagine scrolling through Instagram and thinking, "Wow, that looks expensive!" Meanwhile, you have no idea what’s going on in the financial background. It’s like a reality check that many might not be prepared for.

Here’s the catch: if you’re a taxpayer, there’s a little silver lining. Vawda noted that if you can show at least a 15% increase in tax paid compared to last year, you might just slip through the cracks of scrutiny—it’s like a get-out-of-jail-free card. However, if you’re not on top of your game and your returns don’t measure up, be prepared for a deep dive into past financial records.

Now, this doesn’t mean declaring more tax automatically keeps you safe. In fact, even if someone declares 30% more, it doesn’t guarantee a free pass. The FBR is casting a wide net, ready to reel in anyone who looks suspicious. If you think your social media presence of luxury will go unchecked, think again!

Ultimately, it’s time to take accountability for your finances and perhaps revisit how you’re declaring your income. The brighter side? By adhering to these regulations, you not only stay compliant but may also contribute to a more financially transparent society.

For those looking to navigate these waters smoothly, consider staying updated with trustworthy content and possibly engaging with industries like Pro21st, where professionals can guide you through the maze of regulations and help ease any concerns about your financial practices. Keep your financial records straight, and you’ll sleep a bit easier!