Tackling Pakistan’s Circular Debt: A Historical Financing Agreement

In a groundbreaking move, the federal government of Pakistan has secured a colossal Rs1.225 trillion financing deal with a consortium of 18 banks to combat the escalating circular debt in the power sector. Finance Minister Muhammad Aurangzeb hailed this agreement as the largest restructuring deal in the country’s history, which could pave the way for a healthier financial future.

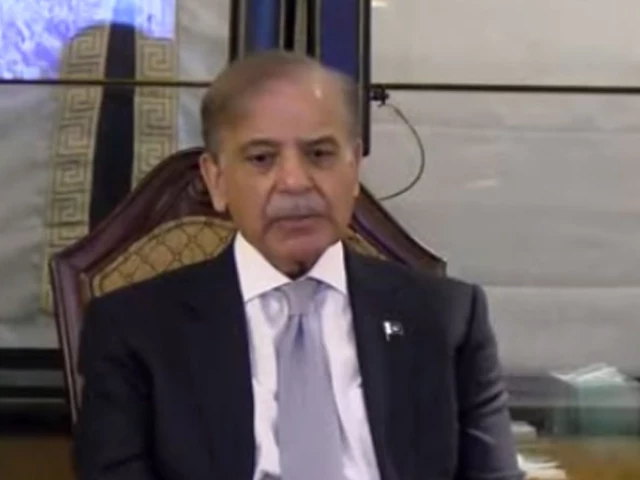

The financing agreement was signed in a ceremony attended virtually by Prime Minister Shehbaz Sharif from New York. This deal was touted as a “significant milestone” in Pakistan’s economic efforts, with Shehbaz commending the task force for their diligent work in making this happen.

The Details of the Deal

Among the financial institutions involved are heavyweights like Habib Bank, National Bank of Pakistan, and Faysal Bank. The agreement comprises Rs659.6 billion aimed at restructuring existing loans and an additional Rs565.4 billion to settle overdue payments to power producers. This influx of liquidity will greatly support not just energy providers but also stimulate sectors like agriculture, SMEs, and healthcare.

Aurangzeb pointed out that this financing facility is beneficial for all parties involved and emphasizes reforms aimed at effectively resolving the circular debt crisis. Notably, the cash flow-backed structure means there’s no new burden on the government or consumers. Instead, existing debt service surcharges will be redirected for repayment.

Looking Ahead

The circular debt issue has been a lingering problem, swelling to nearly Rs2.4 trillion, which constitutes about 2.1% of the GDP. Addressing this crisis not only stabilizes the energy supply chain but also restores investor confidence. The Finance Minister underlined that structural reforms will eventually benefit consumers, while proposals for privatizing power distribution companies are already on the table.

As PBA Chairman Zafar Masud pointed out, the banking sector is stepping up as a committed partner in national development. This initiative exemplifies what can be accomplished when the public and private sectors collaborate with a united vision for economic stability.

Conclusion

This remarkable financing agreement stands as a beacon of hope for Pakistan’s economy, showcasing how strategic partnerships can tackle deep-rooted issues. By working together, the government and banking sector have set a precedent for innovation and resilience. If you’re interested in understanding more about this or seeking ways to connect with initiatives like these, consider exploring resources with Pro21st, where we aim to empower communities through informed discussions around economic development.

At Pro21st, we believe in sharing updates that matter.

Stay connected for more real conversations, fresh insights, and 21st-century perspectives.