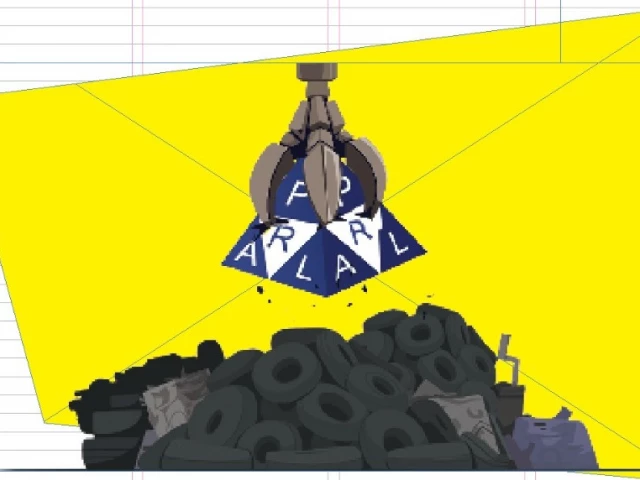

What’s Next for PRAL: Navigating Changes in Pakistan’s Tax System

The recent decision by Amir Malik, the CEO of Pakistan Revenue automation Limited (PRAL), to decline a temporary extension of his tenure has stirred a wave of uncertainty within the organization and beyond. As the government grapples with plans to either shut down or restructure PRAL, employees are understandably anxious about the future.

PRAL is the backbone of Pakistan’s tax system, ensuring that tax transactions run smoothly. Malik’s tenure is cutting short at a crucial time, especially since Prime Minister Shehbaz Sharif has signaled a desire for a more efficient tax management entity. Malik’s refusal to stay on temporarily—which he attributes to a lack of support from both the PRAL board and the Federal Board of Revenue (FBR)—adds another layer to this complex situation.

Interestingly, the government’s plans have not been entirely clear. Initially suggesting a complete shutdown, officials later clarified that the prime minister’s directive was aimed at restructuring PRAL, not dismantling it entirely. In a recent statement, PRAL management expressed optimism about this change, outlining plans for modernization and enhanced functionality as part of FBR’s digital transformation strategy. They assure stakeholders that services will remain uninterrupted during this transition—essential for maintaining taxpayer confidence.

However, uncertainty looms large, particularly among employees. The fear of job losses has already led some senior officials to resign, casting a shadow over workforce morale. Despite these challenges, the board seems focused on finding new leadership, planning to advertise for a new CEO while possibly allowing Malik to contest for the position given his experience.

Another layer to all this is the technology PRAL uses. Many have pointed out that the outdated software and hardware systems are not solely PRAL’s fault. The organization has struggled to update its systems despite having secured foreign loans aimed at enhancing its tech infrastructure back in 2019. This has raised eyebrows regarding the sustainability of services, especially as taxpayers rely on PRAL for filing returns and making payments.

The current situation feels like a delicate balancing act for PRAL and the FBR. They aim to continue providing essential services while navigating significant structural changes. To add to that, the FBR has extended the income tax return filing deadline to October 31, 2025, likely intended to prevent disruption during this transitional phase.

As PRAL looks to the future, the hope is for a well-coordinated and seamless transition—something that requires not just new leadership but also a more efficient system that can better serve both the government and taxpayers.

If you’re interested in staying informed about developments like these, or if you’re seeking advice on how to navigate challenges in the ever-evolving landscape of business and technology, consider connecting with Pro21st. We aim to provide you with insights to help you thrive in a changing environment!

At Pro21st, we believe in sharing updates that matter.

Stay connected for more real conversations, fresh insights, and 21st-century perspectives.