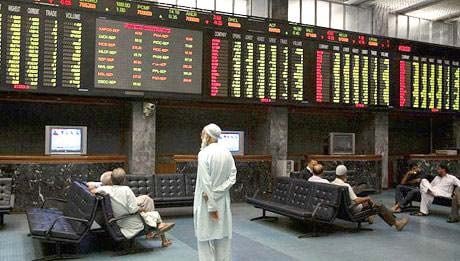

Pakistan Stock Exchange Celebrates Record Close: What Does It Mean for Investors?

If you follow the financial markets, you might have noticed a buzz around the Pakistan Stock Exchange (PSX) lately. The benchmark KSE-100 index soared by a remarkable 1,248 points, reaching a staggering 125,627 at the close of the 2024-25 fiscal year. This isn’t just a number; it reflects a significantly positive shift in investor sentiment and market dynamics.

So, what drove this surge? A key factor was the rollover of a $3.4 billion loan from China, which pumped foreign currency reserves to over $14 billion. This not only meets the International Monetary Fund’s (IMF) reserve requirements but also bolsters the stability of the Pakistani rupee. It’s safe to say that this development sent ripples of optimism throughout the investing community.

Investor enthusiasm didn’t stop there. The PTX’s notable rise can also be attributed to anticipated policy reforms and favorable global emerging market rankings, particularly in Default Risk Reduction. Essentially, this means that investors are viewing Pakistan as a less risky place to invest, which is a game changer for those looking at long-term opportunities in the country.

Trading volumes were robust as well, with over 1,141 million shares changing hands and an overall trading value of Rs35.1 billion. Heavyweights like Fauji Fertiliser Company and Habib Bank Limited played a crucial role, contributing significantly to the index’s upward trajectory.

Now, the fiscal year-end typically brings about a wave of buying activity, and this year was no exception. With strong fiscal flows and an optimistic atmosphere, many experts believe the market is set to continue its upward momentum. For instance, analysts from Topline Securities noted that the market not only met expectations but exceeded them, showcasing the potential for even more gains in the upcoming periods.

As we transition into the new fiscal year, the PSX is laying a solid foundation for future growth, especially if the government follows through on initiatives like reducing industrial power tariffs and privatizing state-owned enterprises.

If you’re intrigued by these developments and looking for ways to engage further, consider exploring resources like Pro21st, which offer insights and support for investors keen on navigating the evolving landscape of the Pakistan Stock Exchange. Whether you’re an experienced investor or just starting out, staying informed is key to making sound financial decisions. Happy investing!