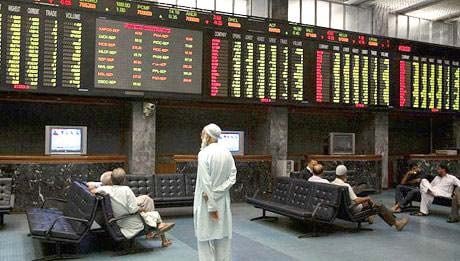

Positive Momentum at the Pakistan Stock Exchange: What You Need to Know

If you’ve been keeping an eye on the financial landscape, you might have noticed some exciting developments at the Pakistan Stock Exchange (PSX). On Thursday, the KSE-100 index continued its upward trend, closing at a remarkable all-time high with an impressive gain of 342.63 points. This brings the index to an impressive 130,686.66, representing a solid rise of 0.26%.

What’s driving this positivity? Well, investor sentiment appears robust, especially after the recent improvement in Pakistan’s foreign exchange reserves, which jumped by $5.1 billion to hit $14.5 billion by the end of FY25. This increase isn’t just a lucky break; it reflects improvements in the current account balance and the successful realization of planned inflows, reassuring investors of the economy’s resilience.

The day was a mixed bag, with significant activity in sectors such as oil & gas, banking, and power. Noteworthy names like Oil and Gas Development Company, UBL, and Hub Power contributed significantly to the index’s growth. However, KTrade Securities pointed out some profit-taking, especially within the banking sector, highlighting the tug-of-war mentality among investors.

The session kicked off on a positive note thanks to the State Bank of Pakistan’s announcement regarding the increased foreign reserves. This spurred a bullish rally, pushing the index to an intra-day high of 131,325. But as is often the case in trading, the initial excitement led to profit-taking that momentarily pulled the index down to 129,776. Fortunately, buyers regained control, allowing the momentum to carry through to the close.

Trading volume saw a decrease, with around 899.8 million shares changing hands compared to 1.03 billion the previous day. The total trade value stood at Rs43.3 billion, involving 468 companies—216 stocks closed higher, and 236 fell.

In summary, while the PSX is experiencing a promising phase, it’s essential to remain aware of the volatile nature of the market and stay informed. As we look forward, the outlook remains broadly optimistic—provided geopolitical stability holds.

For more insights and updates on market movements, consider connecting with Pro21st, where we strive to keep you informed about important economic trends that matter to you. Whether you’re an investor or just curious about the markets, we’ve got you covered!