Understanding the Controversy Over the Super Tax in Pakistan

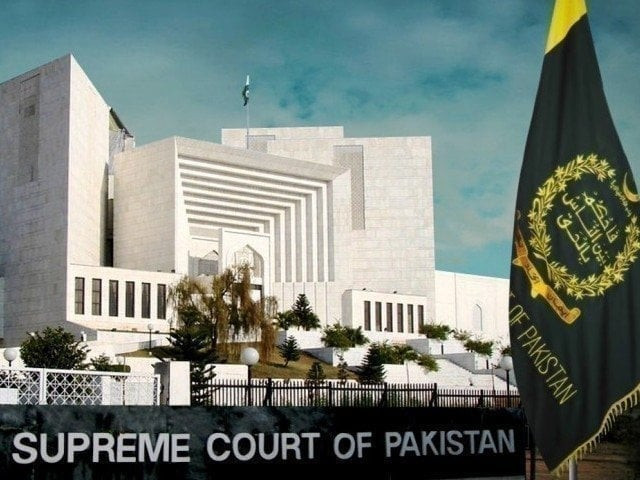

The recent discussions around the super tax imposed by the Pakistani government have created quite a stir, especially within the legal and economic communities. On Wednesday, the Supreme Court questioned the government’s approach, emphasizing that such taxes ultimately affect everyday citizens. This sharp scrutiny raises essential questions about fairness, economic growth, and the government’s relationship with its taxpayers.

A five-member Constitutional Bench, led by Justice Aminuddin Khan, resumed hearings on this critical issue. Advocate Asma Hamid represented the Federal Board of Revenue (FBR), but the judges were not holding back in their concerns. Justice Muhammad Ali Mazhar succinctly pointed out that the burden of taxes doesn’t just affect large corporations; it trickles down to the common man, whether through higher prices for essentials like cement or liquefied natural gas (LNG). He passionately argued that a thriving business environment requires policies that ease the load on taxpayers rather than complicate it.

Justice Jamal Khan Mandokhail echoed this sentiment, warning that discouraging taxpayers could lead to a problematic scenario where they consider leaving the country. This sentiment isn’t just about reducing hate against a tax system; it’s about creating a conducive environment for businesses to flourish.

The bench expressed frustration at the lack of clarity regarding the rationale behind differentiating between various taxpayer sectors. Justice Mandokhail’s question about the absence of justification for such distinction reflects a broader concern: why is the government choosing to favor certain sectors over others? FBR’s Asma Hamid mentioned that the super tax only targeted 15 sectors, which raised eyebrows, especially when no firm claimed their inability to pay.

However, Justice Mazhar was quick to challenge this defense. The real issue lies not just in the sectors being taxed, but in the broader principle of equitable taxation. If the government isn’t careful, budgetary measures could inadvertently shift the financial burden back to the public, defeating the very purpose of such taxes.

Navigating the complexities of tax policy isn’t solely about figures; it’s about trust, transparency, and promoting a prosperous economy. As discussions continue, taxpayers are urged to stay informed and engaged. After all, understanding these issues is vital for the welfare of the economy and everyday life.

If you’re looking to stay updated on similar economic developments or want to dive deeper into financial insights, connect with us at Pro21st. Your engagement could provide the understanding and support needed in navigating these critical issues.

At Pro21st, we believe in sharing updates that matter.

Stay connected for more real conversations, fresh insights, and 21st-century perspectives.