Embracing Digital Transformation in Pakistan’s Tax System

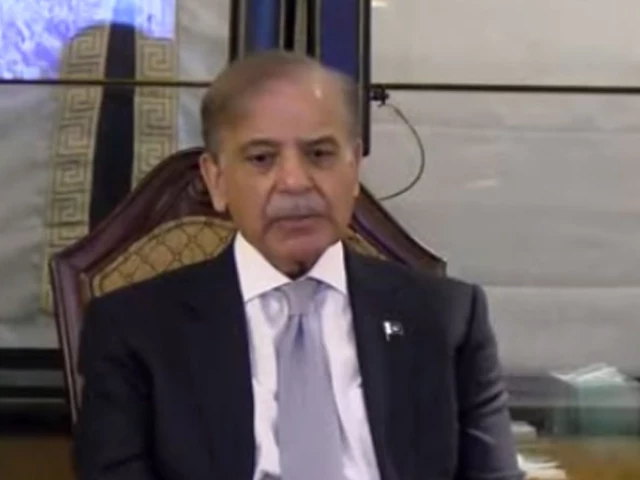

In today’s fast-paced world, adapting to digital advancements is no longer optional—it’s essential. Recently, Prime Minister Shehbaz Sharif emphasized this sentiment by approving the development of a digital ecosystem within the Federal Board of Revenue (FBR). This initiative is part of broader reforms aimed at modernizing Pakistan’s taxation system, a move that many are hopeful will pave the way for transparency and efficiency.

During a meeting in Islamabad, the Prime Minister stressed the importance of involving globally recognized experts to design and implement this new digital system. The goal? To create an integrated platform that connects data from the entire supply chain—right from the import of raw materials to final consumer purchases. Imagine a system that not only allows real-time monitoring but also empowers informed economic decision-making based on centralized data. That’s the vision!

A crucial aspect highlighted was broadening the tax base. The Prime Minister pointed out that reducing the tax burden on everyday citizens hinges on cracking down on the informal economy. By digitizing the tax system, the government aims to create a more equitable framework that supports honest taxpayers while tackling tax evasion with full force.

The historical context cannot be overlooked. PM Shehbaz remarked on the “70 years of mismanagement” that have plagued Pakistan’s taxation framework. His commitment to facilitate honest taxpayers, coupled with a promise of strict action against evaders, signifies a new era in the country’s approach to taxation.

In essence, these reforms could serve as a stepping stone toward a more streamlined, efficient, and fair tax system in Pakistan. As discussions around digitization and automation continue to grow, it’s essential for businesses and citizens alike to stay informed and engaged with these changes.

If you’re interested in navigating this evolving landscape and learning how it might affect you, consider exploring resources that can provide deeper insights and guidance. At Pro21st, we’re dedicated to keeping you connected and informed about these significant developments. Let’s embark on this journey of digital transformation together!

At Pro21st, we believe in sharing updates that matter.

Stay connected for more real conversations, fresh insights, and 21st-century perspectives.