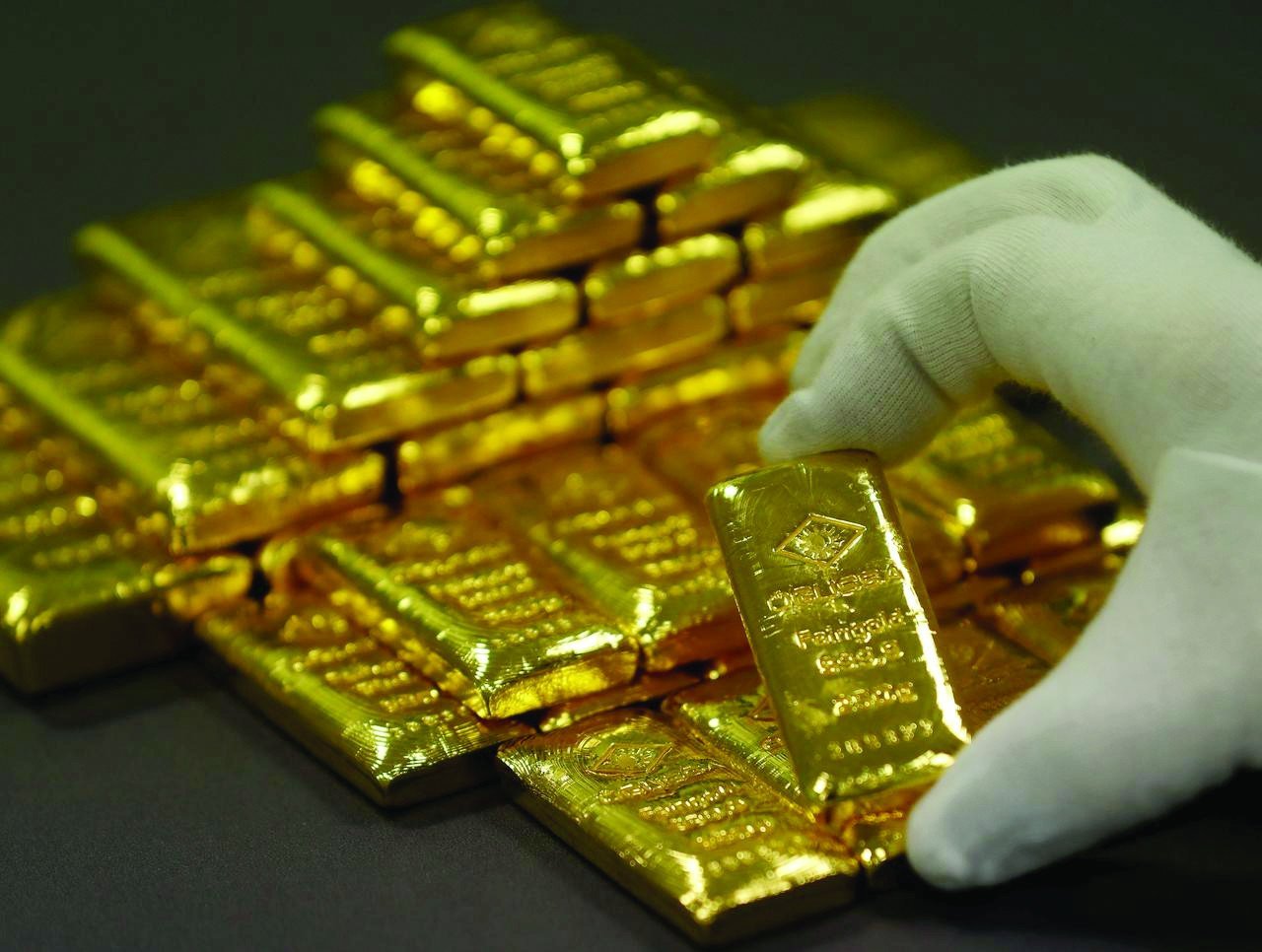

Why Are Gold Prices Soaring in Pakistan?

If you’ve been keeping an eye on the financial news lately, you might have noticed a significant spike in gold prices in Pakistan. It’s a hot topic, and for good reason! Over the past year, the price of 24-karat gold jumped from Rs241,700 to an astounding Rs350,200 per tola. That’s an increase of Rs108,500! The 10-gram rate also surged from Rs207,219 to Rs300,240. So, what’s driving this rise?

The Global Gold Market

One of the main factors contributing to the surge in gold prices is the international market’s performance. Just last year, the global price of gold soared from around $2,326 to more than $3,280 per ounce. This drastic increase reflects rising investor demand as they seek a safe haven for their money amid economic uncertainties. Additionally, the weaker US dollar makes gold more enticing to investors worldwide.

Factors Affecting Local Prices

In Pakistan, a combination of currency depreciation and inflation is also pushing gold prices higher. The rupee has faced consistent pressure, dropping to 283.76 against the dollar—this translates to a year-on-year depreciation of 1.95%. As the buying power of the currency diminishes, the local gold prices inevitably rise.

Current Trends

As of Monday, gold posted a modest increase, with prices rising Rs800 per tola in line with international trends. Discussion in financial circles indicates that investors are keenly awaiting upcoming economic data from the U.S., which may influence future Federal Reserve policies and, in turn, impact gold prices.

What This Means for Investors

For those looking to invest, this is definitely a pivotal moment. Whether you’re a seasoned investor or considering diving into the gold market for the first time, being aware of these trends can help you make informed decisions. As gold has proven to be a critical financial asset during economic fluctuations, now might be the perfect time to assess your portfolio.

If you’d like to delve deeper into financial markets or seek expert advice, consider reaching out to Pro21st. Understand how these trends can shape your future investments, and stay informed. Happy investing!